Increasing Prospects of Global Surplus Weigh on Sugar Prices

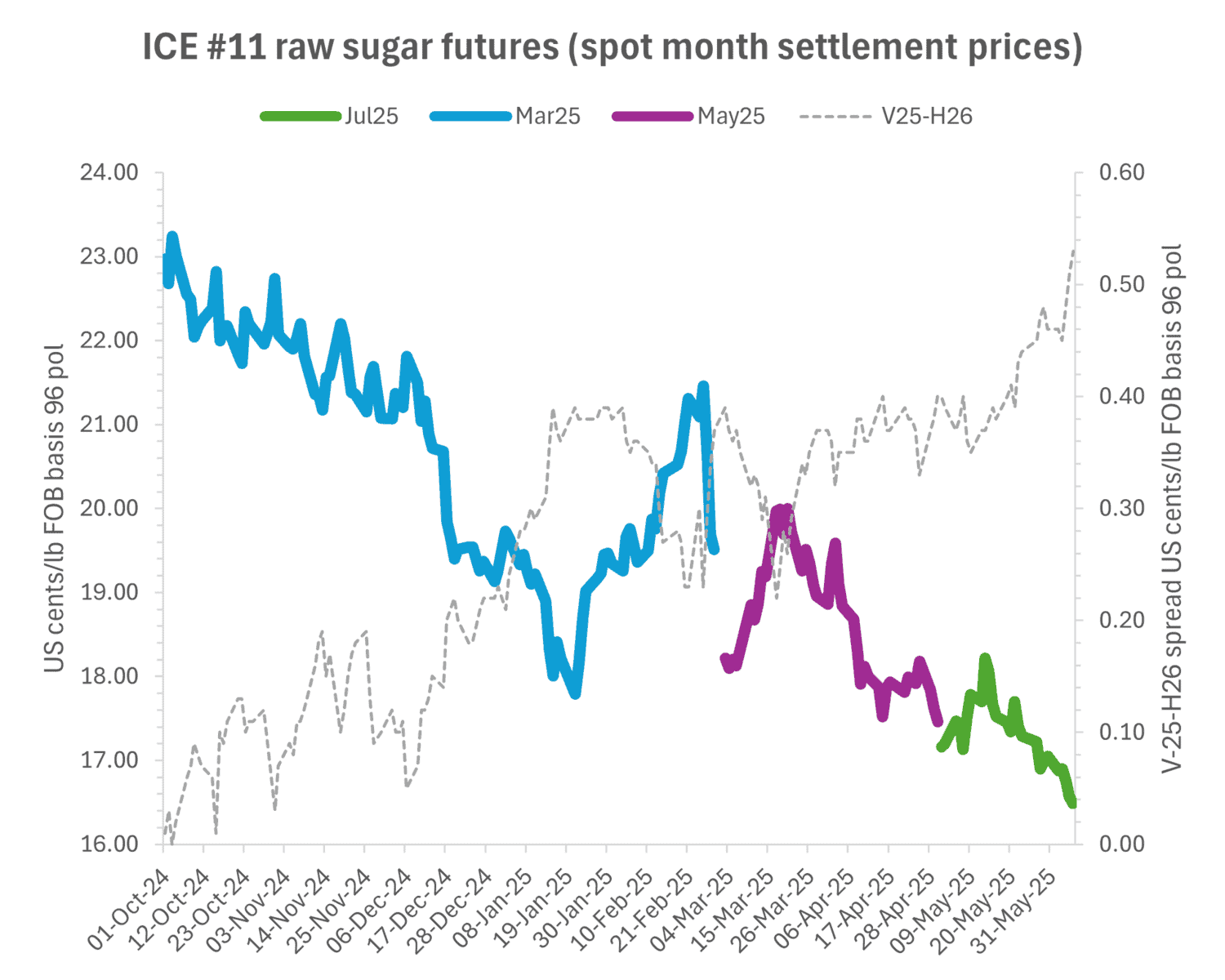

Global sugar prices have fallen 16% since the beginning of 2025 to four-year lows. The ICE New York #11 Raw Sugar Futures Contract briefly rose above 18 cents per pound (¢/lb) during the week of the New York Sugar Dinner in the middle of May, but the downtrend promptly resumed, and the market fell to 16.49 cents per pound on 6 June 2025. The speculative community was reported by the Commodity Futures Trading Commission (CFTC) to be chasing the ICE #11 market lower, with the specs extending their net shorts to 80,798 lots or 4,104,538 tonnes on 3 June 2025. The global white sugar market (ICE London #5 White Sugar) has also continued to fall, partly driven by reductions in raw sugar physical cash premiums, settling at $465.230 per tonne on 6 June.

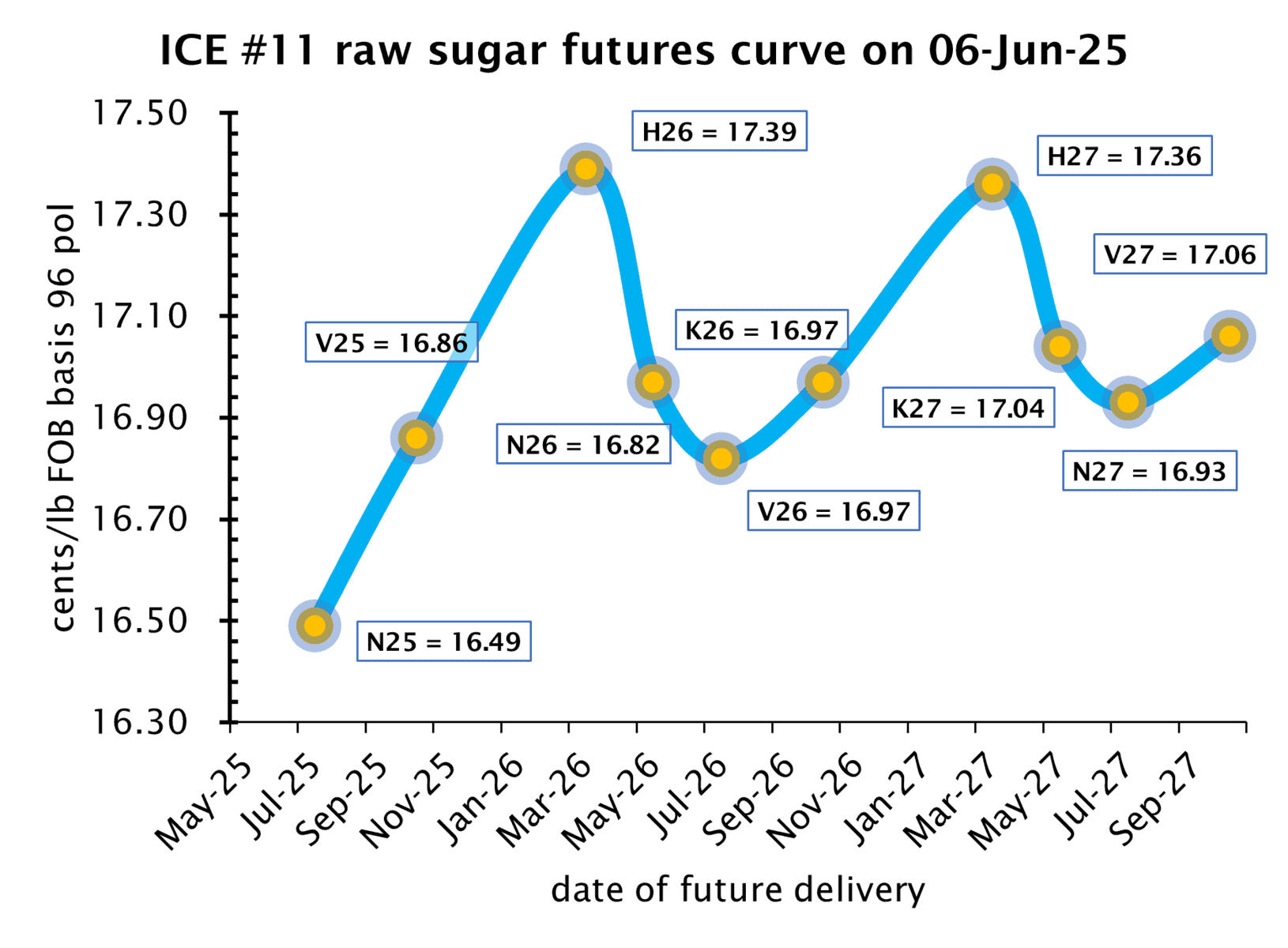

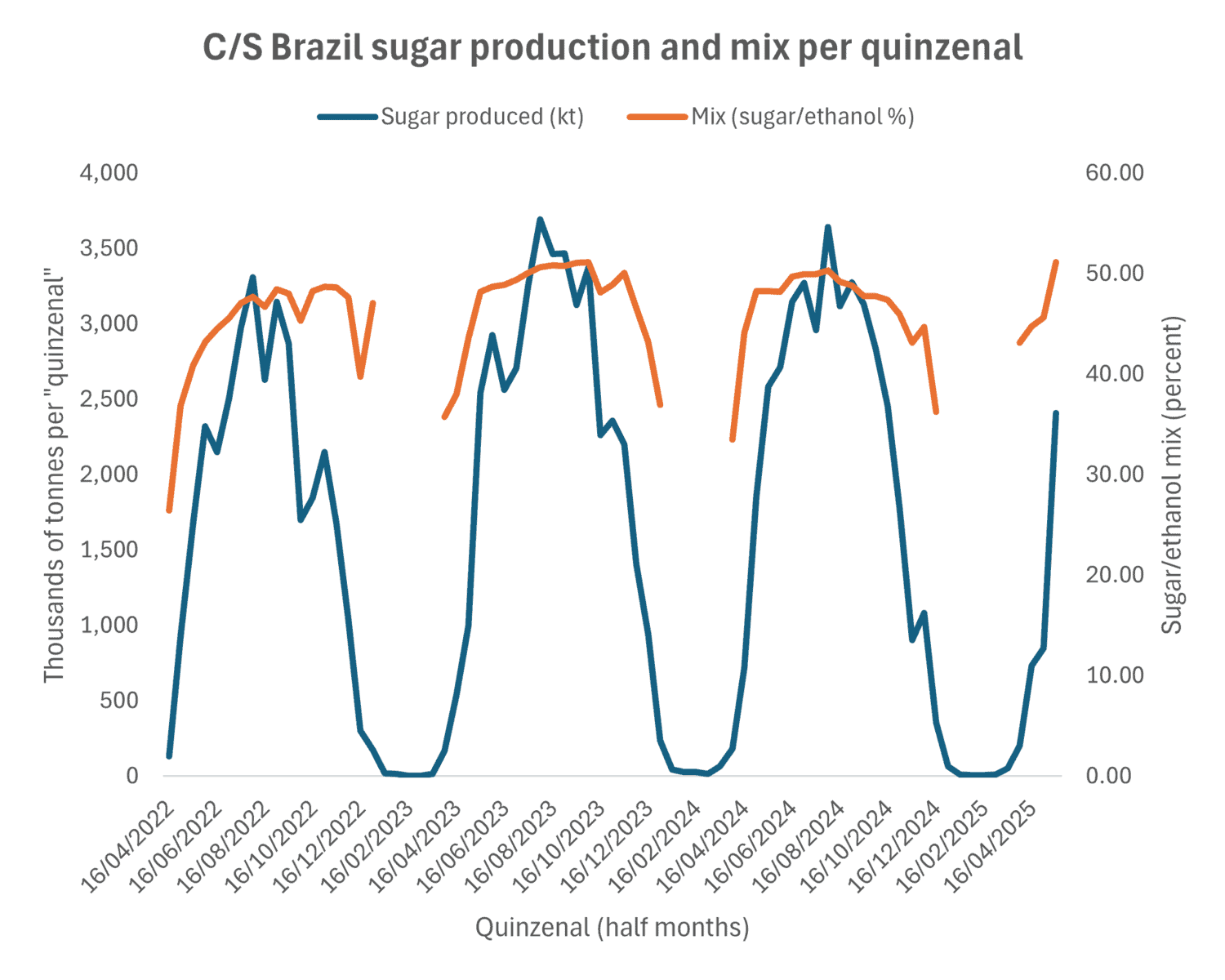

Every day, market players quote one reason or another to explain the day’s trading. Reasons of a fundamental nature have recently included a higher Brazilian sugar/ethanol “mix”, lower stocks, especially in Brazil, increasing Thai selling pressure amid higher Thai white sugar stocks, prolific Indian monsoon rain and a slow pace of Indian exports. Meanwhile, there has been much macro-economic and geo-political news to drive the market up and down (mostly down!), for example, President Donald Trump’s “liberation day” tariffs, weaker-than-expected US economic reports, weaker crude oil prices, and a stronger Brazilian Real. There have also been plenty of weather-related and agronomic developments to analyse and discuss. As market prices ratchet lower, traders ask, “how low can we go?”, and they point to support from Chinese buying at cheaper prices and to the Brazilian ethanol parity which is said to be around 15.5 cents/lb today below which some Brazilian millers could switch cane sugar to ethanol production. Traders at risk of being caught short may also find comfort in October 2025/March 2026 spread (VH) which has risen from around 10 points at the beginning of 2025 to close to at 53 points on 6 June 2025 (17.39 less 16.86 ¢/lb – see charts), perhaps indicating that relatively tight supplies are foreseen in March 2026 and in March 2027 when the new C/S Brazilian crops will hopefully make their way to the ports of loading.

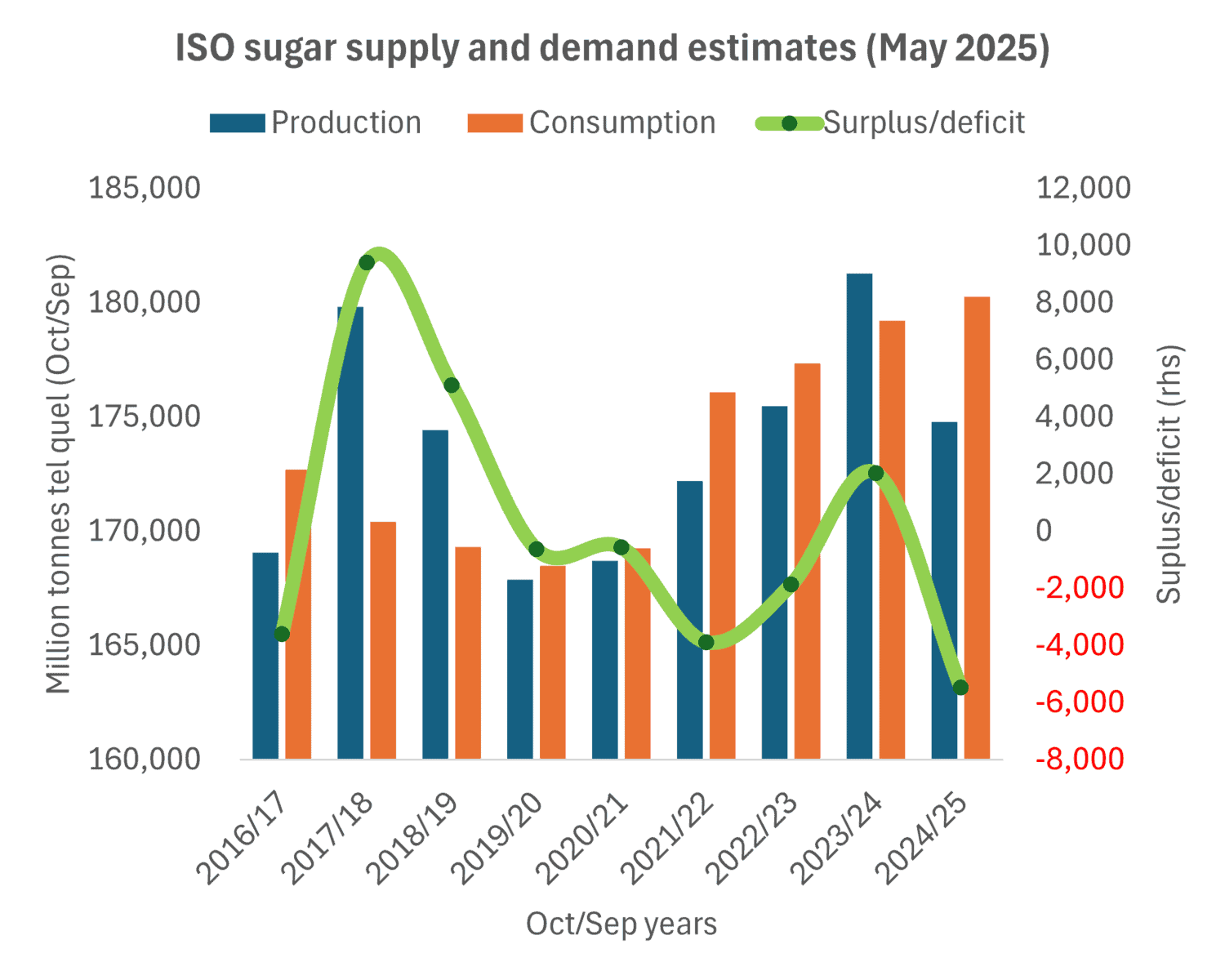

But overall, it seems that the global sugar market seems predominantly to be giving increasing credence to those analysts who foresee that the global supply and demand situation may be turning from a deficit in 2024/25 to a potential surplus in 2025/26.

Issues of supply and demand are concerning but estimates may vary

Different analysts make their calculations of supply and demand (S&D) for sugar on different bases; some compare crop years for each origin depending on the differing seasons in each hemisphere (thus preferring not to “cut crops unnaturally into two parts”), whilst other analysts attempt to standardize their estimates on the basis of October/September years; hence comparisons of S&D estimates between analysts may not always be comparable! That said, the estimates for 2025/26 published in recent weeks have been in very wide range.

For the current 2024/25 October/September year, on 16 May 2025 the International Sugar Organization (ISO) revised its S&D estimate of a global deficit to 5.5 million tonnes, with production at 174.8 million tonnes (down 3.6% from 181.3 million tonnes in 2023/24) and consumption at 180.3 million tonnes (up 0.25%). The ISO noted that a larger-than-hitherto forecast deficit was based on reductions in production in three of the ten largest producers: India, Thailand and Pakistan. The global sugar trader Alvean also forecasts a 2024/25 deficit of 5.5 million tonnes, with a “cautious” surplus estimate for 2025/26 of 400,000 tonnes, down from an earlier estimate of 1.5 million tonnes, citing Brazilian production constraints. The trader Louis Dreyfus also predicts a 400,000-ton surplus for 2025/26, aligning with Alvean’s cautious outlook. The bank Citi estimates a surplus of 200,000 tonnes. The consultancy Safras & Mercado estimates a surplus of 7 million tonnes whilst the Brazilian financier FG/A estimates a surplus of 5.5 million tonnes (but FG/A wisely says it is still too early to make reliable predictions for 2025/26). The financial services company StoneX estimates a surplus of 3.71 million tonnes. The sugar trader Czarnikow predicts a surplus in 2025/26 of 7.8 million tonnes, potentially the second-largest in a decade, noting reduced sugar consumption estimates in western countries where anti-obesity drugs are prevalent. On 7 May 2025, the market intelligence company S&P Global estimated a surplus of 1.92 million tonnes, noting dry conditions in Brazil in May could accelerate the harvest and boost the sugar mix. On 22 May, the United States Department of Agriculture (USDA) predicts an even larger surplus in 2025/26 in its biannual report on world markets and trade, estimating world production for 2025/26 (crop year basis) at 189.3 million tonnes raw value and consumption of 177.9 million tonnes, giving an estimated surplus of 11.4 million tonnes.

Sugar trade flows reveal geopolitical and economic upheaval

Sugar trade flow estimates, available monthly from aggregators such as Trade Data Monitor, are a particularly rich source of information as to what sugar has been trading recently. It is often said that “past performance does not guarantee future results”, but it is often highly useful. These data indicate accelerating sugar trade flows from Brazil to India (no doubt for toll refining), to Indonesia (despite Indonesian government efforts to boost local production), and from Brazil to Malaysia, perhaps also indicating accelerating sugar consumption in Asian countries? Changing trade flows are also seen amongst the ex-Soviet countries, notably accelerating flows from Russia to Kazakhstan, no doubt indicative of the trade sanctions imposed on Russia diverting sugar to and from other markets. Meanwhile, slowing trade flows are seen between Mexico and the US (a result of the stop-start tariffs?), between India and Indonesia, India and Djibouti, India and Iran (Indian sugar being replaced with Brazilian sugar and/or lower local consumption in these destinations?), India and Bangladesh (similarly?), South Africa and Malaysia (lower Far East premiums), and Brazil and Russia (a slowing Russian economy?). These data also reveal a renewal of Chinese sugar imports, sourced mostly from Brazil but also some parcels from Central America and even some sugar from South Korea (no doubt refined Brazilian sugar), but sharply reduced flows from Thailand to China – probably a result of the tensions over Thai exports of sugar syrups and premixes.

The #11 market ultimately looks to C/S Brazil for direction

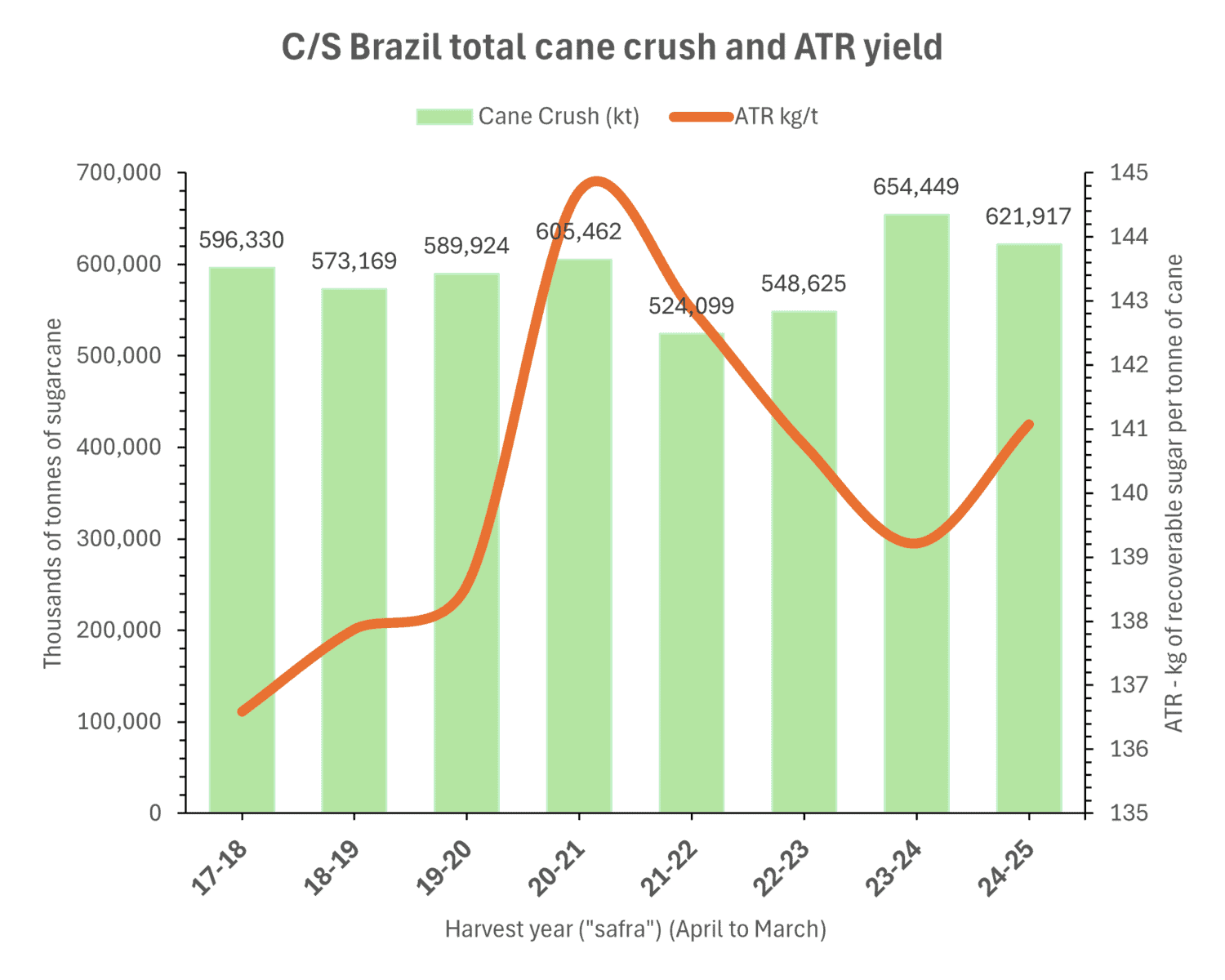

Returning to Brazil, the latest UNICA data for the Centre-South region indicates that cumulative sugarcane crushing from April until mid-May was 76.71 million tonnes (down 20.2% YoY), and cumulative sugar production at a shade under 4 million tonnes (down 22.7% YoY). These numbers are modestly encouraging after the disruptions caused by the heavy rains of April, which have now given way to drier weather conditions in May. However, development of the sugar mix has surprised the market, reaching 51.1% in the first “quinzenal” of May 2025, which was 1 to 2 percentage points higher than expected. Of particular concern, the latest numbers showed Total Recoverable Sugars per tonne of cane (ATR) down 5.1% YoY at 112.25 kg/tonne, and agricultural yields declining over 15%, with the dry May conditions impacting soil moisture. Given the uncertain climate at this early stage, estimates of C/S sugar production vary quite a lot amongst analysts. Alvean predicts a total 2025/26 cane crush of 593 million tonnes (down 5% YoY), potentially falling to 575 million tonnes if yields remain weak. StoneX predicts a 2025/26 cane crush of 608.5 million tonnes, with ATR stable at 141 kt/tonne, an average mix of 51% and total sugar production of 41.8 million tonnes. The USDA predicts 2025/26 sugar production at 44.7 million tonnes raw value (up 2.3% YoY) assuming favourable weather, whilst Louis Dreyfus predicts 39.3 million tonnes of sugar (down from 40.2 mt t), and the government agency Conab predicts 41.8 million tonnes of sugar. The consultancy Datagro reports firmer sugar shipment nominations recently (2.762 million tonnes scheduled, down 6.3% YoY), with China (19.2%), Nigeria (8.4%), and Egypt (7.0%) as key nominated destinations. Port waiting times in Santos remain stable at 12 days, but competition from winter corn (maize) harvests may increase delays at the ports of loading.

The outlook for the global sugar market remains uncertain

Estimates sugar consumption remains enigmatic. The USDA predicts global consumption will rise 1.4% in 2025/26; other analysts apply different percentages to their consumption estimates for a variety of reasons including predicted effects of food price inflation, health consciousness, or the effects of GLP-1 drugs which may reduce demand in G20 nations, so some think. Considerations regarding the politics of oil prices and inconsistent ethanol policies also seem likely to play an increasingly prominent role in market “chit chat” in the months to come, with Brazilian corn ethanol production rising sharply but Indian ethanol blending in gasoline stalling at 18.6% (November 2024 to April 2025) below government targets due to ethanol pricing pressures in India. And as always, the weather will play its part in every sugar producing region of the world, particularly in Asia and Brazil during critical crop phases, and in Europe and Guangxi, China, where drought and pest issues are a big concern.

But so far, the considerations mentioned above all seem to add up to a more than usually uncertain outlook for global sugar markets. Faced with all of this, the natural reaction of market players may be to “play it safe” and continue trading within the established ranges between support from Chinese buying on dips in the market and the rather more concrete support of Brazilian ethanol parity at around 15.5 cents/lb, with Brazilian and Thai selling prices capping the market at around 18 cents/lb.

Register to our quarterly newsletter to stay informed about sugar market trends, sustainability updates, consumer insights, technical information and news about Südzucker innovations.