An Article About “International Sugar Price per Ton” | Südzucker

By: Julian Price; Independent Sugar Trade Analyst; www.julianprice.com

World sugar prices are volatile, rife with speculation, knocked about by the weather, and they are contorted by fiscal, agricultural, environmental, health and other government policies. Moreover, these prices are often below the costs of production for even the most efficient of sugar producers.

And yet world market prices are a transparent and reliable benchmark for around 61 million tonnes of sugar which is traded internationally, or about 36% of global production according to the International Sugar Organization (ISO). And so for many producers and hence consumers, the world market is not just a residual market of last resort – although it is – but it is in fact the only market.

Given these contortions, should stakeholders in the European sugar markets, insulated as we are behind high import tariff barriers, pay much attention to world market prices? Of course, we should! They are often mentioned as the most important influence on the European Union sugar markets and trade policy. But of course we must also pay attention to other important influences and market dynamics in order to plan, adapt and grow of our businesses which rely on sugar.

What – precisely – are world market sugar prices?

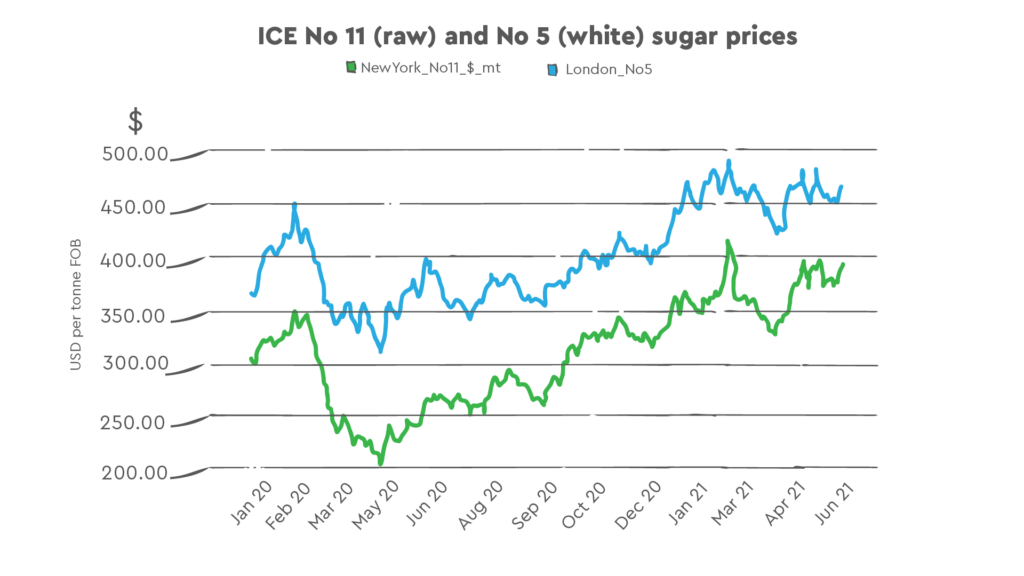

The so-called world market sugar prices are those which predominantly apply on the high seas, not on land. The InterContinental Exchange (ICE) futures prices for raw and white sugar (“New York #11” and “London #5”) apply at the FOB stage of shipment, loaded Free On Board a ship in bulk or 50kg bags ready to set sail to another port across the sea.

As with any commodity, physical supply and demand are the primary factors which ultimately determine the prices which appear on trading screens and indeed on websites such as Barchart. This link to reality is ensured because, unlike cash-settled contracts for differences, at the expiry of each #11 sugar futures month (March, May, July and October), and similarly for the #5 market, sugar futures contracts become physical. If you are long or short of futures on the expiry date, you will become long or short of physical sugar in a port or ports in one of 29 countries around the world – although you won’t know which port until the next business day after the last trading day! In practice, the vast majority of futures contracts are “closed out” well before expiry, many to be subsumed in sellers’ or buyers’ executive orders and other such hedging mechanisms. The daily news, sentiment, trends, and macro-economic variables are among the many factors which determine short-term futures price movements.

In the medium term, the supply of sugar available to the world market tends to be more volatile than the demand, largely owing to endlessly changing weather patterns – international sugar traders therefore pay much attention to weather reports in the main world market supplying countries. In order of size in 2019/2020 these latter are Brazil (40%), Thailand (14%), India (8%), the countries of Central America and the Caribbean (11%), Australia (6%) and of the European Union (2%) (Source: ISO). However, since the onset of the COVID-19 pandemic, we see that demand for sugar is also a more volatile factor affecting the market than it was before the virus.

Since the COVID-19 pandemic struck, the New York #11 sugar futures price (first month settlement) fell from 15.58 cents/lb (US$ 343.50 per tonne) on 18 February 2020, to 9.21¢/lb ($203.00 pmt) on 24 April 2020 as traders foresaw a collapse in sugar consumption owing to the pandemic.Today (9 June 2021), the #11 July futures price has risen to 17.71 ¢/lb ($390.90 pmt).

Prime amongst the many reasons given for the market’s strength in 2021 is fear of inflation caused by the multi-trillion dollar stimulus package which has weakened the US dollar and has sparked a flight of capital towards commodities such as oil, copper, rare earth metals, fertilizers, cereals, soybeans, oilseeds and so-called soft commodities such as coffee and sugar – and bitcoin!

The global sugar market has also been supported by rising ethanol prices – given Brazil’s capacity to divert cane back-and-forth to produce ethanol or sugar – and of course, the weather has played its part: it is dry in the Centre-South of Brazil. To add to the mix of market-making news, any further Indian exports above the six million tonnes already slated for government subsidies will depend on world market prices rising further. Moreover, ocean freight rates have been rising strongly (the Baltic Dry Index is today 2,856), although not (yet?) to the incredible heights reached after the 2008 financial crisis when the BDI reached 11,000 and Sugar #11 reached 35.31 ¢/lb ($778.50 pmt).

Are you interested in this topic?

Overall, market analysts such as the ISO, FO Licht and the major traders such as ED&F Man, are expecting a tightening global sugar supply/demand situation in the coming year or two. With dry weather persisting in Brazil, the momentum of the market appears to indicate that world market prices may rise further, although much will depend, as usual, on the weather in key exporting countries and the overall “macro” situation, including the worrying new wave of COVID-19 inflections in Asia, and particularly in India.

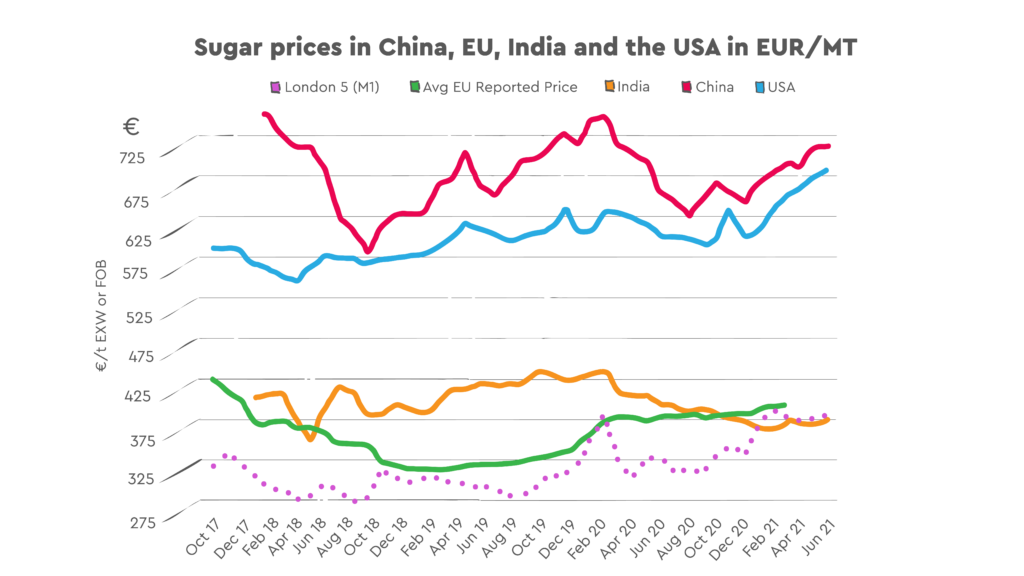

Domestic sugar prices are more or less responsive to world market prices

Amid all the volatility of the world market, domestic sugar prices on land tend to rise and fall at a more leisurely rate. In recent months, no doubt generally in response to rising world market prices, sugar prices in China, Europe and the United States of America have been gently rising, whilst they have barely moved in India, no doubt largely influenced by Indian government policy.

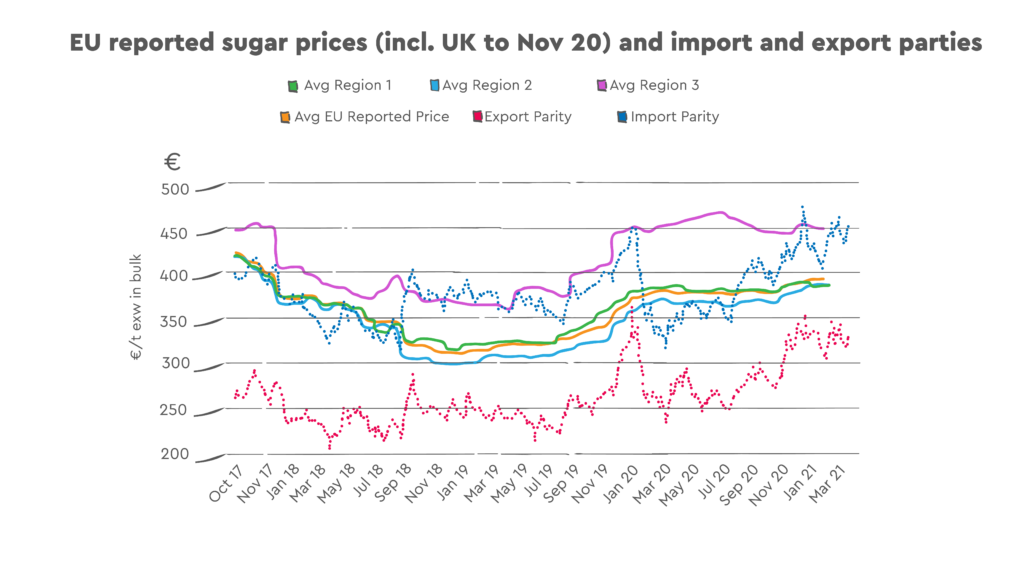

In a remarkable paper published on 9 April 2021, the Association Recherche Technique Betteravière (ARTB) points out that there is a downside to the sluggishness of the European sugar market which is that participants in the EU market do not tend to react to fundamentals and adapt to changes in the supply and demand of sugar. For example, farmers may not receive timely and appropriate market signals before deciding on the share of their arable crop rotation to sow to beet. www.artb-france.com

The ARTB paper notes that the newly liberalized EU market price (since the end of quotas in 2017) tends to swing perhaps once a year between import and export parity – that is between the cost of imported, refined sugar and the ex-works return for export sugar. The reason for this, according to ARTB, is that buyers and sellers tend to negotiate long term contracts – annual or multi-annual – which do not “visibly” contain an indexation or a review clause and hence are unresponsive to short and medium term market signals. However, if EU market prices – not only “spot market” prices but all prices – had risen more promptly in tandem with import parity prices, then the ARTB postulates that we may not be witnessing a decline in the areas sown to beet in 2021. Similar consequences for other stakeholders are not difficult to imagine.

Building on the insight of the ARTB paper, it may be possible to refine this analysis to take account of import and export parity prices in each Member State of the European Union, or at least for groups of Member States. By doing so, it may be possible to demonstrate that greater market transparency and market responsiveness could lead to a more efficient allocation of scarce economic resources and hence to better business decisions for all stakeholders in every region of the European Union and perhaps even in the United Kingdom of Great Britain and Northern Ireland!

World market prices do not tell the whole story – domestic policy “distortions” are also influential

In another remarkable paper first published on 6 May 2021, Dr Marlen Haß of the Thünen-Institut, Braunschweig, asks, “Coupled support for sugar beet in the European Union: Does it lead to market distortions?” (J Agric Econ. 2021;00:1–26) doi.org

As with the ARTB paper but in a different context, Dr Haß is concerned that providing voluntary coupled support (VCS) for sugar beet contradicts one of the main objectives the Common Agricultural Policy which is to achieve a stronger market orientation of agricultural production.

The Thünen-Institut paper demonstrates by means of an econometric model (“AGMEMOD”) that VCS distorts the market within the EU because the subsidies increase production in Member States which grant VCS, resulting in a fall in the market price and a decline in production in non-VCS-Member States. Thus, providing coupled support for sugar beet hampers the reallocation of sugar production to the most efficient regions of the EU. Also, by increasing the competitiveness of the EU sugar sector on the international market, VCS may also lead to adverse effects on third countries, in particular developing countries. Furthermore, consumption of sugar is likely to increase due to lower market prices, the paper asserts, and moreover the ban on neonicotinoid seed treatment for sugar beet in some Member States but not in others, further distorts the markets.

Meanwhile, EU Agriculture Ministers are close to reaching a deal on the next Common Agricultural Policy which, amongst other things, is designed to help EU agriculture to meet the targets set out in the European Green Deal. According to Professor Emeritus Alan Matthews of the Department of Economics, Trinity College Dublin, Ireland, who writes a blog at capreform.eu, the outcome of the latest CAP reform will be “a serious regression from the Commission’s original proposals” that will make it more difficult to reach the Green Deal targets. In his blog, Professor Matthews also asserts that “there are large open questions around the commitment to strategic planning and the institutional capacity to carry it out in the relevant ministries, and on the adequacy of data to support evidence-based policy making”.

As well as evidence-based policy making, Professor Matthews might also have mentioned evidence-based business decisions!

Moving forwards into greater but more interesting complexity

The European Commission certainly seems alive to the necessity to provide as much market data as it can, within the bounds of confidentiality and competition law, to enable better decision making at all levels. Commission Implementing Regulation (EU) 2019/1746 eur-lex.europa.eu seeks to address the issue of information asymmetry in the food supply chain by imposing new obligations on Member States to notify relevant information to the Commission. Although the reporting of sugar selling prices corresponding to short-term contracts (so called “spot prices”) and the reporting of representative sugar buying prices of retailers and food industries appears to be delayed, the obligation to report these prices is clear and keenly awaited. Meanwhile, the Commission continues to improve its Agri-food Data Portal agridata.ec.europa.eu which gives valuable up-to-date data on prices, supply and demand and trade in sugar.

In the old days pre-2006, things appeared easy. The intervention price for white sugar was fixed for us by ministerial fiat at exactly 631.90 €/t ex-works, and, apart from complications arising from so-called “green rates” of exchange between European currency units and national currencies, the EU sugar price didn’t change a jot for year after year after year regardless of the world market prices which ranged between 3 and 60 cents/lb. As we grapple today with “big data” and the myriad of factors and complications affecting us, we might hark back wistfully to the simplicity of the five year plans for the EU sugar sector. But it’s undeniable that things are more interesting in today’s sugar markets. And moreover, by aligning scarce economic resources more closely to market signals in both the global and EU sugar markets, our business decision-making will be all the better.